If you’re like many small business owners or self-employed consultants, you probably have a crossover in your business and personal finances. After all, when it seems like your business is your life, it can be hard to divvy every expense into separate business and personal piles.

Unfortunately, both the IRS and banks place a high priority on keeping these two aspects of life separate. Personal accounting software can help with this problem in several different ways. The Rules of Thumb blog from MoneyThumb has listed those ways below:

1. Instantly Separate Expenses--One of the biggest issues for many business owners is assigning a category to each expense. If you frequently find yourself purchasing items for business at the same time or place that you shop for personal items, you need the ability to quickly click and sort a receipt into categories.

2. Assign a Percentage of Expenses to Categories--If you work out of a home office, then you need to be able to assign a percentage of your utility and rental costs to your business and the other to your personal finances. Even if you’re paying for everything out of the same account, this will be important when you need to compute how profitable your business is.

3. Generate Expense Reports for Tax Purposes--The main reason for keeping your expenses separate is that the IRS needs to know what you spent on your business. Doing this by hand means that you’re probably going to miss a lot of things that can be tax deductible. Fortunately, personal accounting software will scan all of your expenses and determine which items are of interest to your tax preparer.

4. Track Different Revenue Streams--If you earn money from several different business ventures (or if there are multiple income earners in your household) it’s important to keep track of the source of each dollar your household sees. Not only will this be crucial information to have during tax time, but it’s also good for keeping track of which business ventures are actually bringing in income. In addition, personal accounting software is a good idea for families that have a lot of investments outside of their business, such as rental property or stocks.

5. You’ll Save Time--Of course, you can do any of these things without the help of accounting software, but odds are that unless you’re very dedicated to bookkeeping, you’re going to have issues with receipts and bills that go missing or get misfiled. Ultimately, you have to decide if personal accounting software is a good way to avoid spending hours struggling with your business and personal finances.

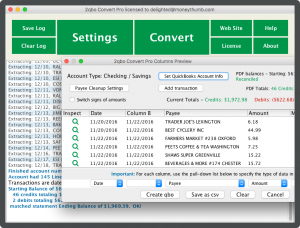

If this Rules of Thumb blog post from MoneyThumb has helped you decide it's time to begin using personal finance software to separate your personal and business spending and income, The Balance offers this article with The 8 Best Personal Finance Software Choices for 2019. Another great way to assist your business is by using our PDF financial file converters which are specifically designed for small business owners. Between the advice we have offered here on personal finance software and our MoneyThumb tools, your business can begin to soar as it should.

Add comment