As a small business owner, one of your biggest and most time-consuming tasks is the keeping of your books. Many small business owners choose to hire a professional to handle their bookkeeping responsibilities. However, you can keep your own books if you have the right tools.

As experts in the field of bookkeeping and accounting, the MoneyThumb team suggests that small business owners use QuickBooks for handling your business finances. This article from Kamps CPA lists 10 reasons to use QuickBooks for business finances. We have listed these 10 reasons below:

10 Reasons Why You Should Use QuickBooks

QuickBooks is the ideal business accounting software for small to mid-sized business owners. Here are 10 reasons why you should be using QuickBooks.

- You save time on bookkeeping and paperwork because many simple bookkeeping tasks are handled automatically making it easier to run your business.

- You can easily generate reports with the information you need, so you always know where your business stands. You instantly know whether you're making money and whether your business is healthy.

- You save money because QuickBooks is so affordable. You can use it to run a $5 million or a $25 million business for a few hundred bucks. PC accounting software is truly one of the great bargains in business.

- Your business can grow with QuickBooks. QuickBooks will help you design a business plan to use when trying to secure a small business loan or line of credit or to plan for the future. QuickBooks will create a projected balance sheet, profit, and loss statement and statement of cash flow in the format recommended by the U.S. Small Business Administration.

- You can customize QuickBooks to work the way you want. QuickBooks is specifically designed to be flexible and adaptable to a wide range of small businesses. To broaden its appeal, QuickBooks has recently added customized accounting packages for Contractors, Retailers, Health Care Professionals, and Non-Profit organizations.

- You can rest assured knowing that QuickBooks is a stable, reliable and proven product. Hundreds of thousands of small businesses throughout the world have chosen QuickBooks as their accounting software. You can't go wrong with a software program with such an extensive installed user base.

- You save typing time and errors by sharing data between QuickBooks and over 100 business applications. You can even share data with popular programs, such as Microsoft Excel, Word, Outlook, and ACT.

- You will get paid faster with QuickBooks online payments. E-mail an invoice or statement and with QuickBooks Online Billing, your customer can easily pay you with a credit card or bank account transfer. No more waiting for the check, in the mail!

- You can easily accept Credit Cards. With QuickBooks Merchant Account Service, you can accept credit cards with ease. QuickBooks Merchant Account Service is the only credit card acceptance service integrated with QuickBooks software, which means you don't have to enter the same data twice. No additional software or hardware is required. Your customers can use Visa, MasterCard, or American Express.

- You can pay your bills and bank online. Setup your current bank account in QuickBooks and you're ready to pay your bills without licking envelopes, sticking stamps, or printing paper checks. Just write checks in QuickBooks as you normally would, then click a button and your participating bank does the rest! Pay anyone in the U.S. from your credit card companies to your pizza service. Online Banking also lets you download your monthly statement from your participating bank directly into QuickBooks for easier reconciliation.

If you use QuickBooks to handle the finances of your small business most of the time the latest version of QuickBooks--with its upgraded section on Banking--will allow you to handle all your bank transactions in an accurate and quick manner. This feature of QuickBooks provides a complete QBO (Web Connect) File from your bank that makes the data entry process easy as pie.

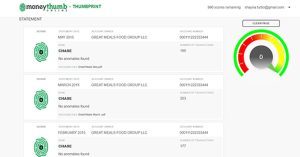

But when you do not have access to your QBO (Web Connect) files, MoneyThumb tools will help you easily convert your business bank statements. Below are a few scenarios in which MoneyThumb tools assist you in converting bank files in QuickBooks:

- If you get a CSV (or Excel Spreadsheet) with all the bank transactions, you can use the CSV2QBO tool to convert it

- If you get a QIF file (some banks can export to QIF and not QBO, PayPal is a great example) you can use QIF2QBO to convert it

- If you get a PDF file (Bank Statement) that are the original digital PDFs from the bank, you can use PDF2QBO con convert it.

- If you get paper statements, you can use ScanWriter or PDF2QBO+ from MoneyThumb to scan them and convert them to QBO.

All of the above MoneyThumb tools are proven to be 10x faster than manual data entry.

As you can see, QuickBooks and MoneyThumb are a marriage made in heaven when it comes to taking care of your business finances. This leaves you SO much more time to make your business a success rather than being mired down in accounting tasks.

Add comment