Many of the readers of The Rules of Thumb blog from MoneyThumb are accountants who handle the sensitive financial information of clients. We have found that a lot of you also serve as financial planners and/or use financial planning software. The very nature of having clients' financial information in your possession presents an opportunity to cyber thieves intent on stealing your clients' financial data, so you have a big responsibility to do all you can to keep your clients' data secure.

So what are the best practices to keep data in your financial planning software out of the hands of nefarious cybercriminals?

1. Financial Files Should Be Password Protect

Protecting files in your financial planning software with iron-clad passwords gives your data an extra layer of protection. Passwords prompt user familiarity when accessing the file. And if a cybercriminal attempts to crack the code, they're instantly thwarted. Password protect your entire client database to go the extra mile.

2. Trust Your Instincts

Nothing beats common sense. Even if your organization deals with cold hard facts, going with your instinct can prevent a major breach. Daily monitoring of data in your financial planning software allows you to stay on top of any sudden change. Understanding client behavior helps as well. For example, if a customer typically calls or prefers to interact in person when dealing with their finances, stop and think if they suddenly begin to email or text. Cybercriminals only require one opportunity to strike, leaving financial planning organizations vulnerable when not keeping an eye out for suspicious behavior. Always have a fail-safe plan once old habits get questionably broken.

3. Stay Educated

Regardless of your job description, it's always a good idea to stay on top of the latest phishing and hacking techniques. Make an effort to educate the employees of your accounting firm on new cyber threats. If your company is not large enough to hire a dedicated security specialist, assign or have someone volunteer to host monthly sessions informing employees about security concerns. Choose one day of the month to provide lunch catering, thereby, enticing employees to attend a company meeting during lunch. These meetings provide a tremendous ROI with minimal cost to your organization and reduce the likelihood of a financial planning software breach.

4. Limit the Amount of Information Collected

Even with the most state-of-the-art security systems and protocols, clients can't help but worry about the safety of their financial identity. To mitigate this concern, limit the amount of personal client information collected to first and last name, age, state of residence, and email address. Stay away from collecting social security numbers, date of births, physical addresses, and employment information. Anything that will give away their identity is serious bait for cybercriminals.

5. Limit Access

If your financial planning software allows you to collaborate with multiple users, limit their functionality depending on the user. Sure, this feature allows other financial advisers, attorneys, or accountants to access the files remotely, but it also expands a cyber criminal's reach.

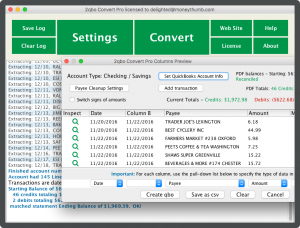

As the creator of the best in PDF financial file converters, MoneyThumb uses Pinpoint OCR, (optical character recognition) our proprietary algorithm that instantly flags questionable transactions. This is just one more way you can help protect your clients' sensitive financial information.

Add comment