The accounting system you choose to manage your company’s finances is a decision that can determine many aspects of how your small business operates. To help you make the right decision about which accounting system is right for your business, The Rules of Thumb blog from MoneyThumb has created a list below of the 6 most important things to consider when choosing your business accounting system.

But before we begin, we'd like to point out a couple of crucial things to keep in mind. One, very basic accounting systems require little to no upfront investment, but they will be next to impossible to upgrade. Two, as your company expands an overly complicated program takes weeks to learn, making it difficult to quickly enter information and generate the reports and data you need to effectively run your business.

In this article, PC Magazine reviews 10 accounting systems for small businesses and lists the pros and cons of each one. That article can be a big help in making your decision, but you should also consider the following six factors before choosing your business accounting system:

Room for Expansion

As your company grows, it is going to rely on more people to handle its finances and accounting. Unfortunately, many basic programs only allow one user at a time to change files and enter information, with no way to expand the number of people who are able to use the program simultaneously. When a company grows to the point where it needs multiple people to handle the bookkeeping and accounting, it’s typically not a good time to install a new accounting software package. Plan ahead by investing in a program that will give your company room to expand.

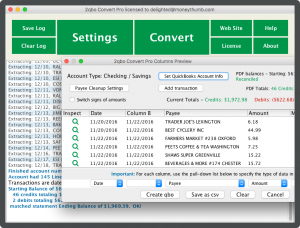

Communication with your Bank

Long gone are the days when a business would reconcile its books with a mailed bank statement once a month. Today, it’s critical for your business to be in constant communication with your bank; your accounts are updated every time a new transaction occurs. Look for an accounting system that can easily receive and read files from your banking institution.

Ability to Generate the Reports You Need

Accounting software doesn’t provide your business with any benefit if you can’t get the data you need from the information you enter. Carefully review the types of reports that a program can produce, and consider if they will meet all of your business’ needs now and in the future. If a program cannot provide the functions that you want, and there is no simple way to add to the program to get those functions in the future, keep looking.

Ease of Use

An accounting system should be simple enough to use so that you or your accounting staff can figure it out with a minimal amount of time devoted to training. While larger, more complicated programs may require advanced training for some staff members, there’s no need for every person in the department to be stuck in months of training seminars. There are plenty of options available on the market that are intuitive when it comes to entering data such as invoices and bills. Many programs also come with excellent Help, Tutorial, and Troubleshooting programs and/or websites that can explain how to perform more advanced or rarely used functions.

Compatibility with Other Software Programs

Your accounting software will need to be able to generate reports that can be opened and read by everyone from your accountant to your customers. Make sure that it produces them in a format that has wide compatibility.

Security

Your accounting software will contain some of the most sensitive data about your company, your employees, and possibly even your personal finances. Even though you’ll still need to take steps to protect your computer system, take a few minutes to read reviews regarding a program’s internal security.

By taking all of the above information into consideration, you should be able to acquire just the right accounting system that fits your business needs. MoneyThumb offers PDF financial file converters specifically designed for small businesses which will compliment whichever accounting system you to decide to use.

Add comment