Although traditional accounting software is still the standard for the majority of small businesses, many business owners are making the leap to cloud-based accounting. To help you decide which is best for your small business, below are some pros and cons of both types of software, traditional and cloud-based:

Traditional Accounting Software

Small businesses have relied on traditional accounting software such as QuickBooks for years. Longevity means a large number of expert users, support guides, and other documentation that can keep you up to speed. Experts agree that desktop programs are usually more feature-rich and powerful than cloud-based competitors, and you don’t need a fast Internet connection (or any Internet connection at all) for most features. Finally, this is a one-time expense. You pay for your software and can use it indefinitely without shelling out more cash (at least until you need to upgrade to a new program).

Of course, one major con of traditional accounting software is that access is limited to wherever you’ve installed it. This can also make it hard to use collaboratively — this is typically a one-user-at-a-time scenario for small businesses. You have to be extra careful to back up your data, which could be swallowed up in the black hole of a computer crash or malware attack. Finally, you’ll need to periodically check for software updates to keep things running smoothly and take advantage of new features.

Cloud-Based Accounting Software

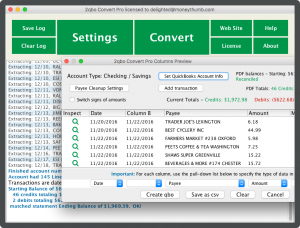

One of the biggest advantages of cloud-based accounting is accessibility. As long as you can get online, you’ll be able to access your account. Because the software lives online, you won’t have to worry about updates and backing up your work — that’s all automatic. You’ll also be able to collaborate more easily with others, and can even work simultaneously if your platform allows multiple users. You can link up your account with your bank or other cloud-based applications such as PayPal, which can save you from some tedious data entry.

Still, since cloud-based accounting is relatively new, you may find there are fewer experts to guide you, and industry-specific platforms are rare. Depending on your needs, you may also find some advanced features are missing, such as customer relations management or purchase order control. Price can also be a big downside here: You’ll have to pay month after month for a cloud-based service. At roughly $20 a month (the price of a low- to mid-tier cloud accounting solution) it will take you about a year to equal what you might pay for basic traditional accounting software — however, you’ll still keep paying after that, and prices for premium cloud accounting run $30, $40, or even more a month.

What About Security?

Many small-business owners have been reluctant to put their financial data online because of security concerns. Certainly, no one wants their account numbers in the hands of hackers. However, most experts agree this concern is overblown, and shouldn’t dissuade you if you’re thinking of moving your accounting to the cloud. After all, your data is probably more at risk on your old desktop or laptop, whether that’s from a computer crash, a virus, a theft, or even something like a fire. In contrast, cloud accounting companies know their own businesses are at stake in the event of a major data breach, so they spend a lot of time and money keeping their security top-notch.

Bottom Line

If you need features or truly industry-specific support that you can’t find in cloud accounting, it may still be best for you to choose traditional accounting software. Otherwise, it probably makes the most sense to head online.

You may find in your journey toward cloud based accounting that you need one of our file converters. Check out our product recommender to find out which one that would be.

Add comment