We're going to have a bit of fun at the Rules of Thumb blog from MoneyThumb today.

If you are old enough to remember the Twilight Zone, then you probably remember these prophet words from the host, Rod Serling. "There is a fifth dimension beyond that which is known to man. It is a dimension as vast as space and as timeless as infinity. It is the middle ground between light and shadow, between science and superstition, and it lies between the pit of man's fears and the summit of his knowledge. This is the dimension of imagination. It is an area which we call the Twilight Zone."

Robert W. Wood, the tax and litigation expert and writer for Forbes.com has written this great article concerning how Bill Gates thinks that robots should be taxes. Since it's tax time, we thought it would be the perfect time for a review of this article, and a little tongue-in-cheek fun for our tax professionals and accountants. Goodness knows if there is anything lacking during this season, it is a more humor.

Bill Gates Says Robots Should Pay Taxes

Bill Gates made billions with Microsoft, but recently made a widely-publicized anti-tech message. He commented that after all, robots should pay taxes too. If robots take jobs, he suggested, one way to level the playing field might be if all those robots had to pay taxes just like the rest of us:

Right now, the human worker who does, say, $50,000 worth of work in a factory, that income is taxed and you get income tax, social security tax, all those things. If a robot comes in to do the same thing, you’d think that we’d tax the robot at a similar level.”

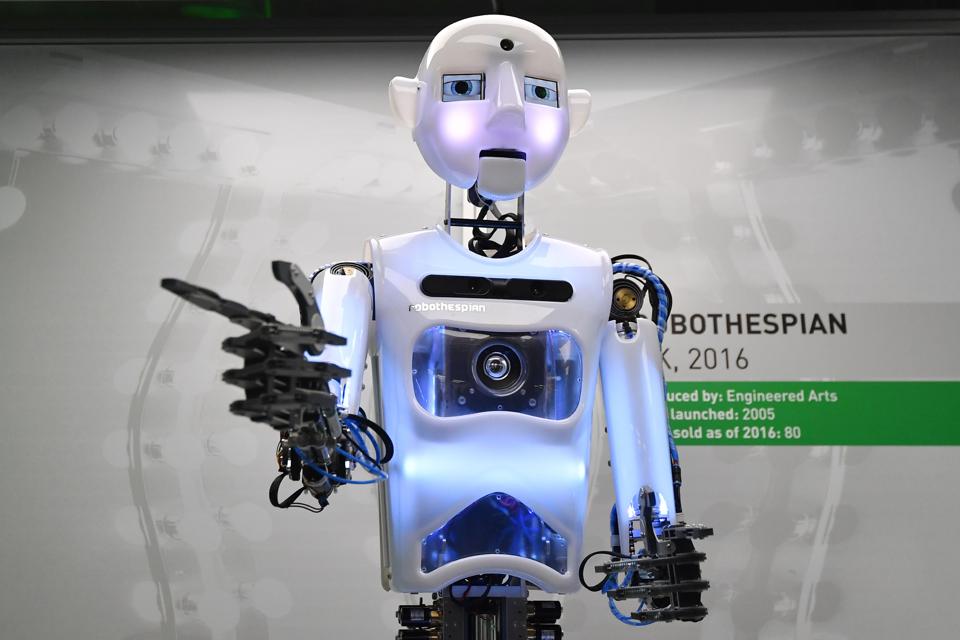

A robot produced by Engineered Arts named 'Robothespian' UK, 2016 is on view at the ROBOT exhibition at the Science Museum in London on February 7, 2017. (Photo credit BEN STANSALL/AFP/Getty Images)

You can read more about Bill Gates calling for income tax on robots, see the video on Quartz, or the written interview in its original form. Then, like me, you can start wondering about the specifics. But just think of it: robots surely will be like the rest of us, trying to pay as little as we legally can. The tax system is notoriously complex, and perhaps Robots will be good at the system. It is no coincidence that H&R Block now partners with IBM Watson for machine intelligence. According to TechCrunch, you can let Watson find tax deductions, using its natural language processing to parse the 74,000-page federal tax code.

TechCruch says "these are just the sorts of problems that machines tend to outperform humans in solving." Sure, there are tax credits and tax deductions. But what about bigger stakes? It is commonly said that tax lawyers spend approximately a third of their time trying to convert ordinary income into capital gain. The line between capital gain and ordinary income has always been important.

The corollary to capital gain treatment is generally basis recovery even before one has gain. Then too, there are capital losses to consider. Individual investors often find themselves trapped with large accumulated capital losses from which they can benefit only at a painfully slow pace, able to offset a mere $3,000 of ordinary income per year. Some taxpayers find themselves arguing for capital gain treatment for an income item not because they are trying to reap the advantage of the 15 or 20 percent rate. Rather, they are seeking to soak up accumulated losses, losses that might otherwise languish until the next ice age.

For entities, the focus on capital gain is mixed. S corporations, in my experience, seem preoccupied with it. Their shareholders benefit from the flow-through of these items on their Schedules K-1. That also is true with limited liability companies and partnerships. C corporations do not receive a tax rate preference, but even they can care about the distinction. Thus, the distinction between capital and ordinary remains vital, not just for planners and those handling tax controversies, but for lawmakers, too.

One need look no further than the carried interest debate to find fierce discussion. Of course, that discussion is not so much about whether capital gain treatment and rate preferences are a good idea, but rather about precisely what should be capital and what should be ordinary.

Imagine if you will, a world where robots pay taxes and begin to stress about capital gain. Makes you wonder what kind of portfolio Rosie the Robot from the Jetson's had. 🙂

Add comment