For many years, large businesses were the primary users of accounting programs. The cost to use these programs was high, and most required that the user be an accountant with months of training on the program. As software costs have gone down, however, a slew of home finance software have entered the market.

Home finance software packages focus on tracking expenses, paying bills, and budget planning. Some will link up with outside investment and banking organizations, too, to add real-time information to your money management spreadsheets. Working with software that is easy to set up, intuitive to use, and well-maintained are considerations when choosing the right software for you. If you’re thinking of using accounting software, consider these options:

Quicken

This highly-rated software has a reputation for being slightly harder to use than some others, but can track a wealth of data. If you have multiple accounts, or if you want to coordinate your home accounts with your business finances, this program might be the one for you. Quicken allows users to do much more than track their bills and savings. It can:

- offer projections on investment accounts

- coordinate with banks and other financial institutions to update accounts in real time

- remind you to pay bills

Quicken has a great reputation for helping people with their investments, making it an excellent choice for an individual or family that needs help tracking multiple accounts. The program is capable of modeling possible changes in a portfolio, such as buying or selling stocks. Mobile apps sync directly with your desktop. There are three different versions of Quicken, depending upon your financial analysis needs.

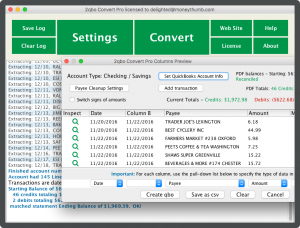

Moneydance

A powerful budgeting program with a user-friendly screen, Moneydance will allow you to sync with your financial sites (checking, credit cards, loans) and also allows manual data entry. Multiple accounts or budgets are easily managed. Reports are easy to understand and customize. There is a portfolio overview feature, too. Mobile apps (utilizing DropBox), for on-the-go budget adjustments, are useful. ConsumerReports.org named Moneydance one of its top ten in 2015.

Online Programs

There are plenty of free and fee-based online home accounting programs such as Wave, Mint, Check.me, Doxo, and Manilla. While the quality and ease of use varies with these apps, it is important to realize that many of these programs (especially the free ones) have the right to collect and use your data. For this reason, most financial experts do not recommend using them to keep track of account numbers and other sensitive information. These programs do offer a variety of calculators, however, that can help you save for college, find a mortgage, or plan your retirement. Use the tools and calculators, but don’t store your data with them.

One online option that scores high with ConsumerReports is Buxfer. The dashboard includes a useful overview of your accounts and the program is easy to use. Bank uploads and budgeting are its strengths. Report options are more limited but useful; there are reports for expenses, income and net worth. The investment tools cannot link directly to market reporting sites.

Add comment